GPS LEADERS

Real-Time GPS Tracking At An Awesome Price With 5 Star Customer Service.

BHPH Tracking – Only $89 Includes 5 Years

Fleet Tracking $15.98/month

No Hidden Fees or Contracts

Volume Discounts Available

High Quality Products

3 Year Warranty

Real-Time Tracking

Google maps + street view

Safeguard Privacy

Stay regulation compliant

One-Stop Shop

Platforms for every need

Award Winning

Industry leading solutions

5 Stars Reviews

Top notch customer service

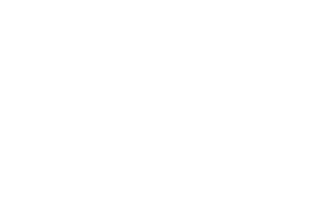

GPS Leaders Is Buy Here Pay Here Lender Approved!

Introducing the GPS Leaders All-in-One Buy Here Pay Here Lender Recovery Solution. Stop repossessions before they start and recover stolen vehicles faster. With our software you can increase recovery rates, reduce storage costs, improve risk management, all while protecting your bottom line.

Lender Repo Recovery Software

Recover vehicles faster! Our Repo feature streamlines the repossession process, saving you time and money.

Impound Lot & Zone Protection

Reduce storage fees! Receive instant alerts when your vehicle enters restricted zones or impound lots nationwide.

Risk Assessment

Mitigate losses! Quickly identify risky borrowers and potential problems before they escalate with our reports and alerts.

Starter Interrupt

Take control! Disable vehicles remotely with the optional starter interrupt feature. Avoid chasing vehicles down, saving time and money.

iOS & Android Mobile Apps

Manage on the go! Our easy-to-use mobile apps keep you in control from anywhere, anytime.

GPS Leaders Is Buy Here Pay Here Lender Approved!

Introducing the GPS Leaders All-in-One Buy Here Pay Here Lender Recovery Solution. Stop repossessions before they start and recover stolen vehicles faster. With our software you can increase recovery rates, reduce storage costs, improve risk management, all while protecting your bottom line.

Lender Repo Recovery Software

Recover vehicles faster! Our Repo feature streamlines the repossession process, saving you time and money.

Impound Lot & Zone Protection

Reduce storage fees! Receive instant alerts when your vehicle enters restricted zones or impound lots nationwide.

Risk Assessment

Mitigate losses! Quickly identify risky borrowers and potential problems before they escalate with our reports and alerts.

Starter Interrupt

Take control! Disable vehicles remotely with the optional starter interrupt feature. Avoid chasing vehicles down, saving time and money.

iOS & Android Mobile Apps

Manage on the go! Our easy-to-use mobile apps keep you in control from anywhere, anytime.

Ready to generate an ROI?

Thousands of GPS Leaders customer see an immediate savings within 30 days.

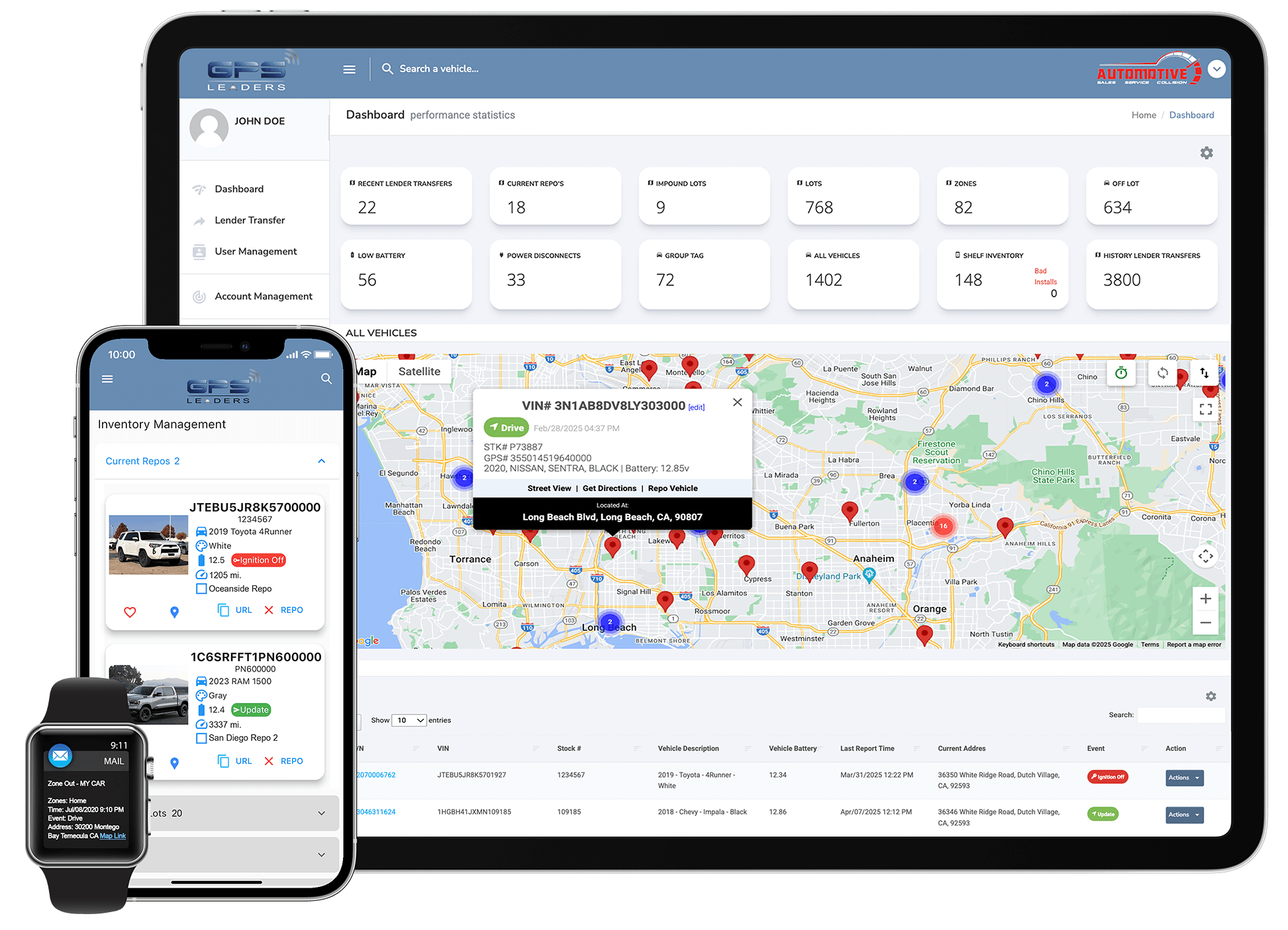

GPS Leaders Makes Fleet Tracking Simple!

GPS Leaders Fleet Tracking solution immediately reduces costs and boosts profits for your business. Easily track fuel usage, manage fuel efficiency due to idling and mitigate liability with driver behavior reporting to reduce overhead expenses and generate an ROI for your business.

DIY Fleet GPS Install

Easy 1-Minute Install! Plug-and-play device that plug into the vehicle OBDII port, no electrician needed.

Real-Time Fleet Tracking

Easily manage your fleet! With 30 second updates quickly access event reports, location and mileage information, plus vehicle trail history.

OBDII Diagnostics

Preventative maintenance! Get notified of engine issues before breakdowns with check engine light alerts.

Job Site Management

Improve Customer Service! Know your ETAs and dispatch the closest driver for faster service. Accurate arrival times equals customer satisfaction.

Driver Behavior Monitoring

Reduce risk and improve safety! Monitor harsh braking and speeding to promote safe driving and accident prevention.

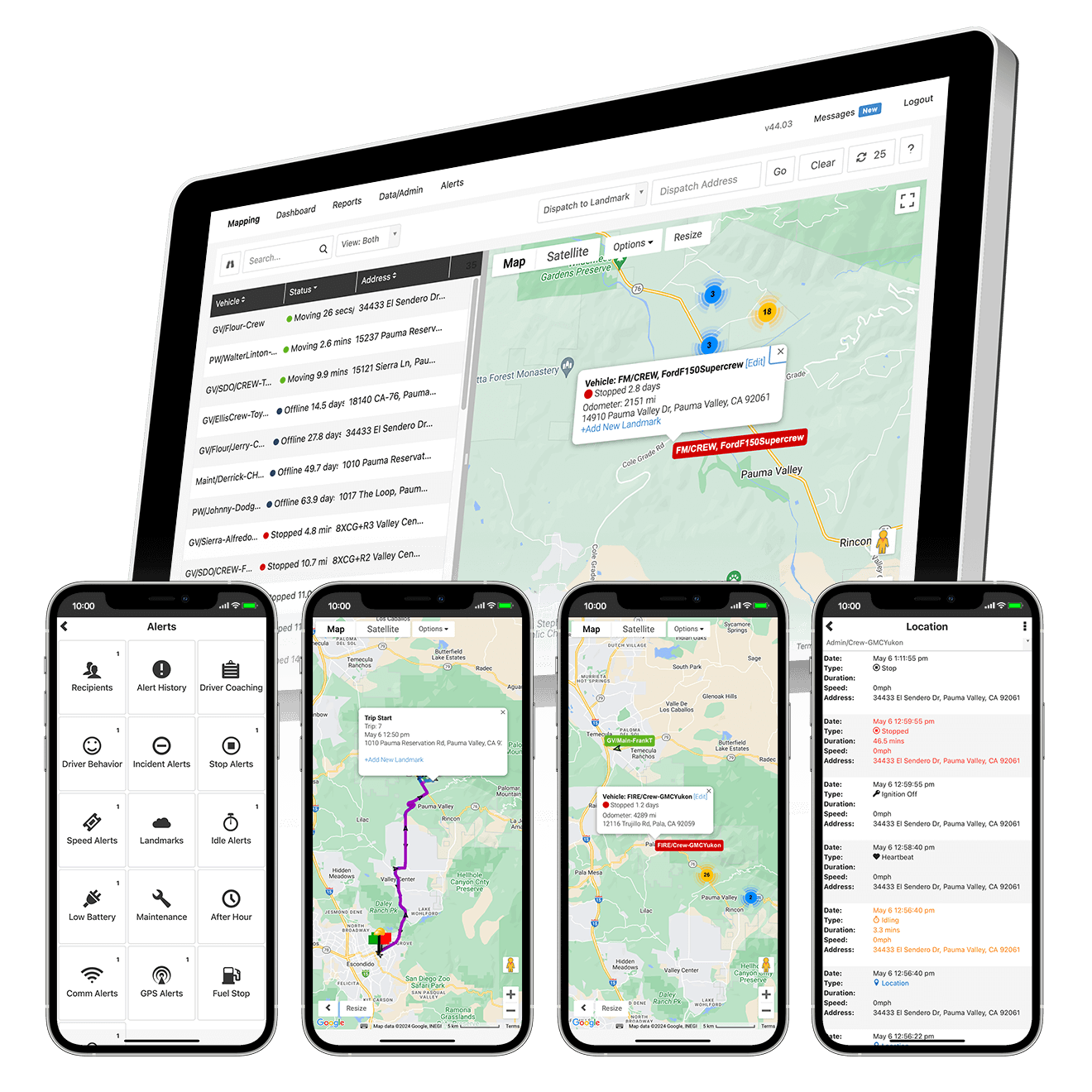

GPS Leaders Makes Fleet Tracking Simple!

GPS Leaders Fleet Tracking solution immediately reduces costs and boosts profits for your business. Easily track fuel usage, manage fuel efficiency due to idling and mitigate liability with driver behavior reporting to reduce overhead expenses and generate an ROI for your business.

DIY Fleet GPS Install

Easy 1-Minute Install! Plug-and-play device that plug into the vehicle OBDII port, no electrician needed.

Real-Time Fleet Tracking

Easily manage your fleet! With 30 second updates quickly access event reports, location and mileage information, plus vehicle trail history.

OBDII Diagnostics

Preventative maintenance! Get notified of engine issues before breakdowns with check engine light alerts.

Job Site Management

Improve Customer Service! Know your ETAs and dispatch the closest driver for faster service. Accurate arrival times equals customer satisfaction.

Driver Behavior Monitoring

Reduce risk and improve safety! Monitor harsh braking and speeding to promote safe driving and accident prevention.